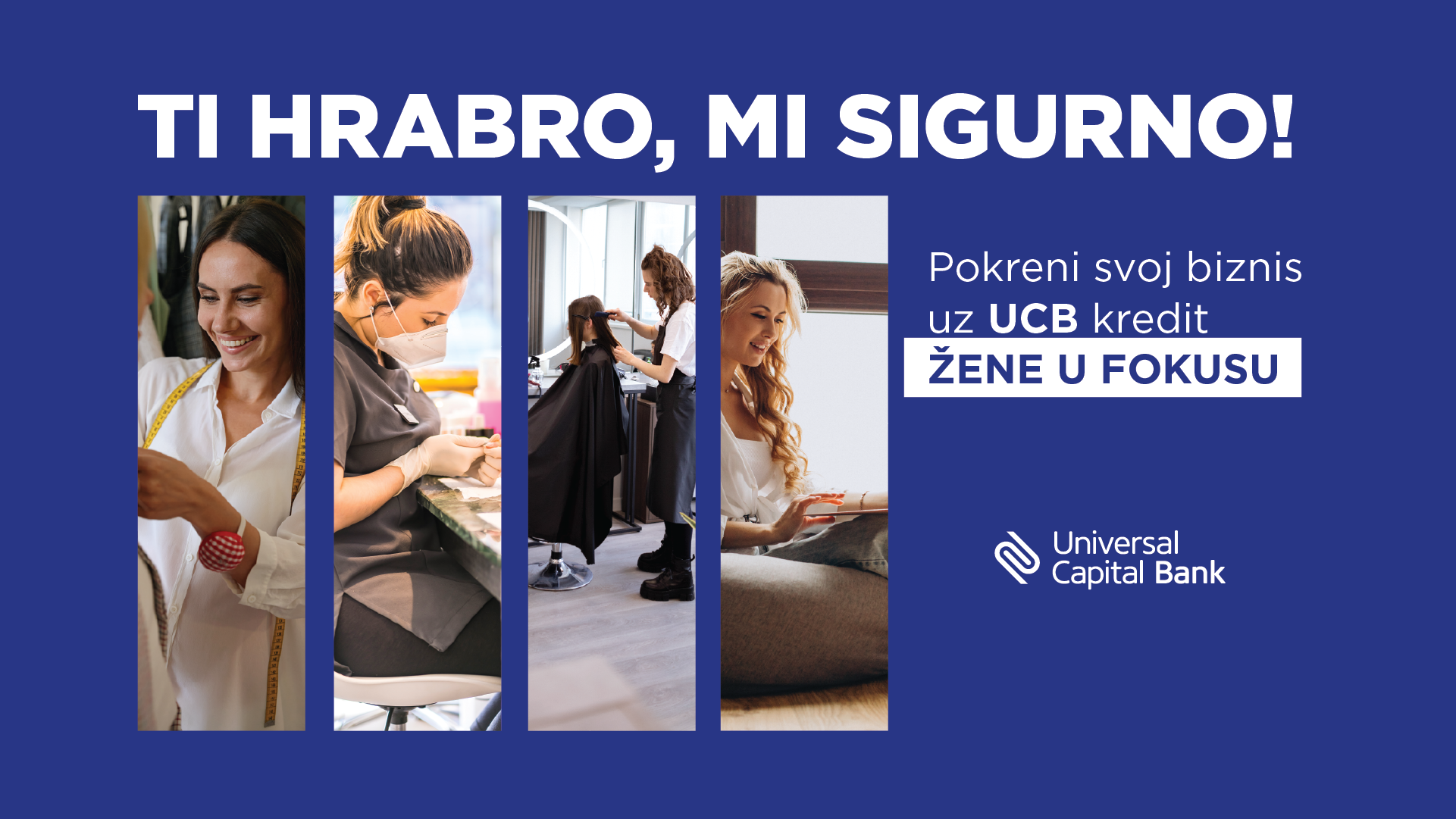

You Lead with Courage, We Provide Security!

Universal Capital Bank’s New Credit Line for Women Entrepreneurs – Women in Focus!

Universal Capital Bank has launched a dedicated credit line titled “Women in Focus”, aimed at supporting women entrepreneurs. Introduced shortly after International Women’s Day, this credit line tailored for women offers loans with fixed interest rates, longer repayment terms, and the grace period option.

The “Women in Focus” credit line marks a significant step toward the economic empowerment of women in Montenegro. This initiative provides women-owned businesses with access to financial resources under more favourable terms, enabling them to grow their businesses and achieve their professional goals.

In March, Universal Capital Bank signed a Cooperation Agreement with the Secretariat of the Competitiveness Council, thereby formalizing initiatives to further support women’s entrepreneurship within the “Women-Owned Business” Trademark Project.

Under this Agreement, companies that are official holders of the “Women-Owned Business” trademark will not be subject to additional verification or documentation requirements when applying for financial support intended for women entrepreneurs. Universal Capital Bank, as the financial provider, will not request additional evidence of ownership or management structure for these businesses.